Navigating O‘ahu’s New Short-Term Rental Rules: What Changes in September 2025

Are you confused about what counts as a short-term, mid-term, or long-term rental—and how the new 90-day rule will shake up your property plans? Stick around, because I’m breaking it all down in the simplest form.

Let’s start with the basics:

- Nightly Rentals / Short-Term Rentals (STRs): Anything rented for less than 30 nights. Think vacation rentals, Airbnbs, or VRBOs—these are considered STRs under Honolulu law24.

- Mid-Term or Month-to-Month Rentals: Rentals for more than 30 days but less than 6 months. These are popular with traveling professionals, remote workers, or folks in transition.

- Long-Term Rentals: Leases of 6 months or more. These are the traditional rentals that provide stability for both owners and tenants

Background & Legal Context:

The original push for a 90-day minimum began with Honolulu City Council’s Bill 41 (Ordinance 22-7) in 2022, which faced legal challenges and was temporarily overturned by a federal court ruling that reinstated the 30-day minimum.

However, subsequent amendments to the Land Use Ordinance have revived the 90-day rule, which will take effect later this year.

Why the 90-Day Rule?

Honolulu aims to prioritize housing for locals, as short-term rentals have driven up prices and displaced residents. A UHERO study suggests eliminating STRs could reduce home prices by 6% and rents by 8%. While controversial, the city is betting on long-term community stability over tourism-driven income.

Exceptions:

- Located in legally designated STR zones, such as resort areas (e.g., Waikīkī). Waikīkī, Ko Olina Turtle Bay Makaha

- Covered by a valid Nonconforming Use Certificate (NUC), which allows short-term rentals under specific conditions

- Your property has been operating as a MID term 30 days or more before 10/23/2022. You may be allowed to continue operating under the old rules, thanks to “grandfathering” protections.

4 Ways to Protect Your Investment

Pivot to Niche Mid-Term Rentals

- Target: Remote workers, traveling nurses, or academics needing 1–6-month stays.

- Perks: Offer themed packages (e.g., “Digital Nomad Retreats” with coworking memberships) or partner with hospitals for staff housing.

Convert to Long-Term Rentals

- Pros: Stable income, lower turnover, and eligibility for lower property tax rate.

- Cons: Reduced flexibility and potentially lower nightly rates.

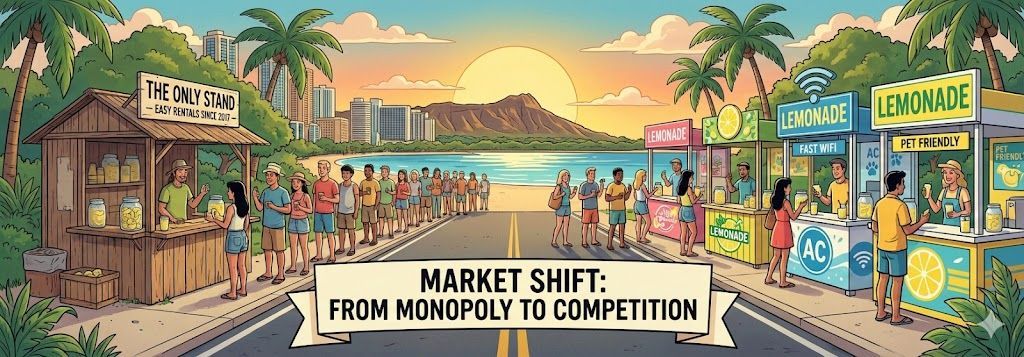

- Market Shift: Expect a flood of long-term inventory, which could suppress rents unless demand rises.

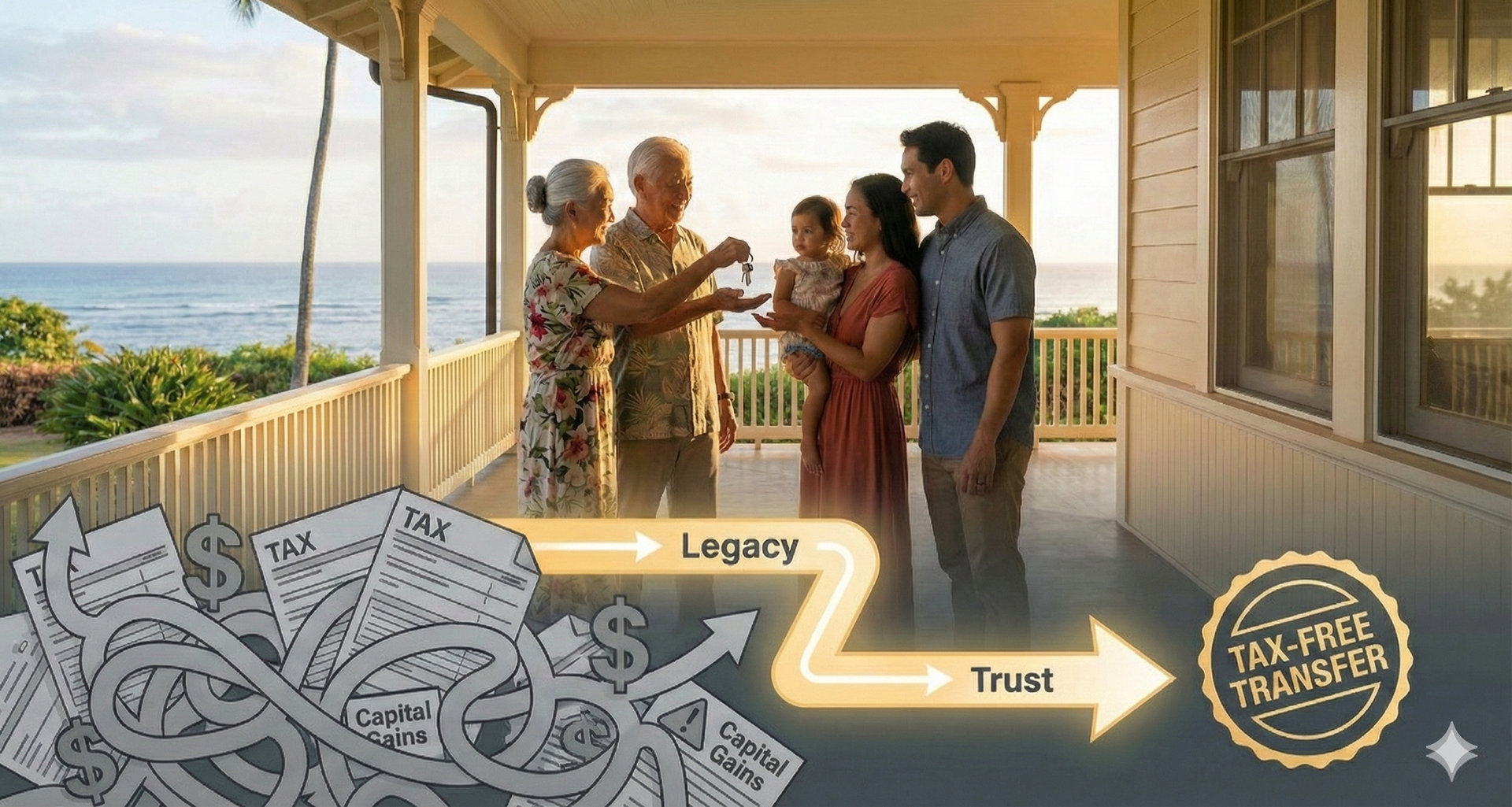

Sell and Reinvest in STR-Zoned Properties

- Hotspots: Waikīkī, Ko Olina, and Turtle Bay properties will become more valuable due to scarcity.

- 1031 Exchange: Defer capital gains taxes by reinvesting proceeds into a qualifying STR-zoned property.

Secure a Nonconforming Use Certificate (NUC)

- Grandfather Clause: Properties operating as mid-term rentals before October 2022 may qualify.

- Catch: NUCs are being phased out—act fast before deadlines tighten.

What This Means for Property Values:

- STR-Zoned Areas: Prices could skyrocket as investors chase limited inventory.

- Residential Zones: Values may dip as rental income shrinks, but long-term demand from locals could offset losses.

- Wild Card: A surge in sales from frustrated owners could create a buyer’s market this summer.

The Bottom Line

The 90-day rule is a double-edged sword: it prioritizes housing for residents but disrupts a lucrative rental market. For owners, adaptation is critical—whether through niche marketing, conversions, or strategic sales.

Need help navigating the new rules? As an O‘ahu property manager, I’m tracking every update—reach out for tailored strategies.