The Unseen Challenges of Oahu Leasehold Properties – A Seller's Tough Choice

I want to share a real-life closing story that perfectly shows just how unique and sometimes tricky our island's property market can be. We're going to dive into the world of leasehold properties and what happens when they get a rare chance to become fee simple – and how I helped a client navigate all the twists and turns.

Leasehold vs. Fee Simple: What's the Deal?

First off, let's clear up some terms. When you own a property in Hawaii, it's usually one of two types: fee simple or leasehold.

- Fee Simple is pretty straightforward: you own the building and the land it sits on, free and clear, forever.

- Leasehold, however, is a bit different. With these properties, you own your unit, but you essentially lease the land underneath from a landowner for a set period. Think of it like renting the ground your condo is on. Leasehold properties often have a lower initial price tag than their fee simple counterparts, making them a more accessible way to get into the Oahu market.

But here's where it gets interesting – and sometimes challenging. Because you don't own the land, getting a loan for a leasehold property can be tough. Many banks are hesitant to offer long-term mortgages, especially if the lease is running out soon. They often require the lease to extend at least 5 to 10 years beyond your loan term, and there are usually rules about how long the rent is fixed. This means the pool of potential buyers for a leasehold property is much smaller, usually limited to cash buyers or those willing to accept shorter, less common loan terms.

A Client's Dilemma at Discovery Bay

Now, let's talk about my client at Discovery Bay. He owned an investment condo there with incredible, unobstructed ocean views. Here was his situation:

The building's association had a chance to buy 96% of the land under the building from Bank of Hawaii for $78,000, turning it into fee simple. The remaining 3% wouldn't be available until 2039, with no set price yet. To top it off, there was a strict deadline: if he didn't act before May, that $78,000 price would jump by 30%!

So, he had a tough decision: Should he buy the land interest now and then sell? Should he sell the unit as-is, still leasehold? Or should he buy the land interest and hold onto the unit? While the unit was paid off, with these new changes, he became aware that he was no longer interested in keeping the property, having no future plans to move back.

More Than Just the Land: Unit Challenges & Market Competition

His decision wasn't just about the land. His unit itself had its own set of hurdles:

- It had all original cabinets, making it look a bit dated compared to other renovated units in the building.

- A tenant was currently on a fixed lease for at least another six months, which can be a turn-off for buyers who want to move in right away.

- Crucially, due to the complications with financing leasehold properties mentioned earlier, the pool of buyers for his unit was already significantly limited. This meant fewer potential offers and a longer selling process if listed on the open market.

- And to make things even more competitive, there were more listings in the building at that time, meaning more competition for his unit.

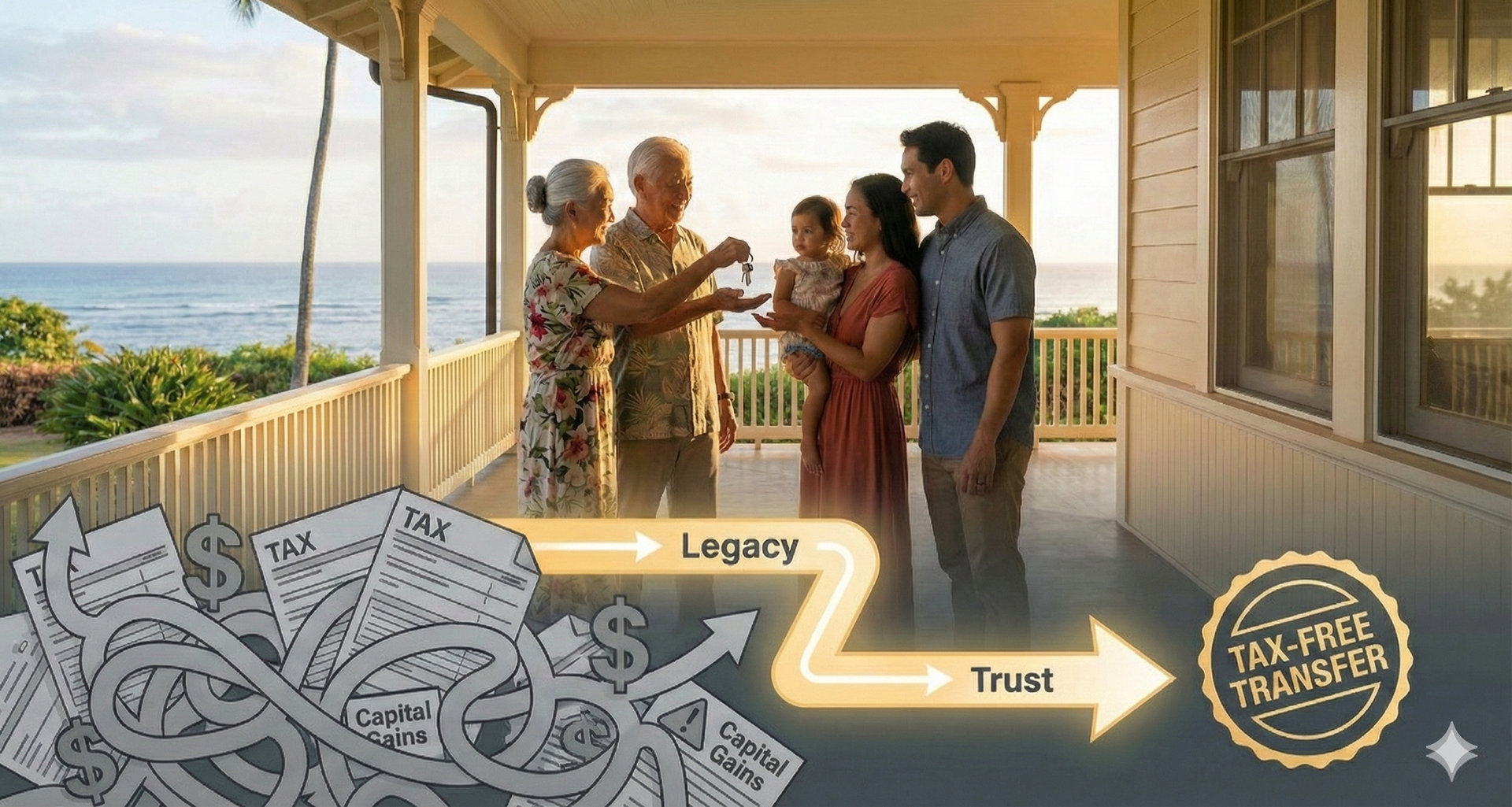

My client's main goals were to sell quickly and get the best possible return, all while being mindful of capital gains and potential recapture taxes (since it was an investment property).

Finding the Right Path: My Approach

To help him make the best choice, I didn't just give him a single option. I broke down every scenario in detail. We looked at all the estimated closing costs for each path, along with the potential tax implications.

After thoroughly discussing everything and giving him time to think it over, we decided to try something strategic first: we'd test the waters with my network of cash investors. The idea was to see if we could get a quick, off-market sale.

And it worked! Within days, we had a strong offer from a cash buyer in my network. While he briefly considered listing it on the MLS for even broader exposure, the attractive offer and the promise of a quick and clean closing perfectly aligned with his need for speed and simplicity. So, he chose the cash buyer.

How I Help My Clients

This story really highlights what I aim for with every single client:

I don't just list properties; I listen to your goals, analyze the numbers, and present clear options without any pressure. Whether it's putting your property on the MLS or connecting you directly with an investor (with no extra fee for the introduction!), my job is to help you make the most informed and confident decision for your unique situation.

Thinking about selling on Oahu, or just curious about your leasehold or fee simple options? Let's chat! Book a quick consultation with me – I'm here to help you navigate the market with clarity and confidence.