ChatGPT's Advice vs. On-the-Ground Reality

I asked ChatGPT for its advice on strategic real estate investing for building wealth. Here's what it said, along with my thoughts and experiences from the Oahu market.

Buy and Hold for Cash Flow & Appreciation

Acquire properties in growth markets and rent them out. Over time, these appreciate in value while also generating monthly income, building both equity and steady cash flow.

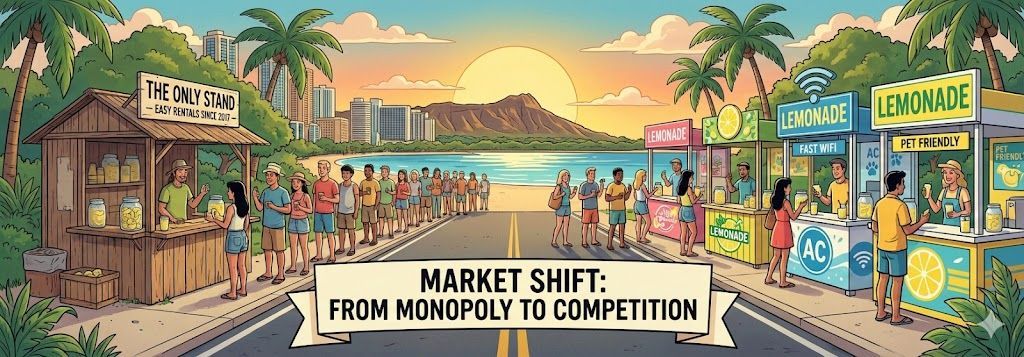

My Thoughts: While I agree with this strategy in theory, I'm not convinced Oahu's market is always ideal for it. In my experience as a property manager since 2017, the rent often falls just short of covering a client's mortgage payments. The good news is that securing a tenant has been relatively easy in recent years with low vacancy times. However, with the recent changes to short-term rental rules and a current lack of sales, I have noticed rentals sitting on the market for longer.

Leverage and Scale

Use mortgage financing (“leverage”) to control valuable assets with less upfront capital. As properties appreciate and tenants pay down the mortgage, your equity grows exponentially. You can then refinance or use equity to buy more properties and scale your portfolio.

My Thoughts: This principle holds true, and the big advantage in the Oahu market is that properties appreciate by an average of 4% annually. So, while your tenant covers most of the mortgage, you can rest assured that your equity is growing. However, it's worth considering the full picture: if your rental property here in Oahu is running a deficit of around $300 a month because the rental income is too low, is the 4% appreciation increase truly enough to make the numbers work?

Diversify Asset Types

Invest in a mix of single-family homes, multifamily properties, condos, or even vacation rentals to spread risk and stabilize returns. Diversification can also include passive vehicles like REITs or syndications.

My Thoughts: Absolutely. It’s also wise to diversify beyond real estate with investments like stocks and retirement funds, and even consider international options. When it comes to the Oahu market specifically, I see single-family homes as the best investment property choice, especially those with an ADU or a separate living space.

“House Hacking”

Purchase a multi-unit property, live in one part, and rent out the rest to offset your housing costs and build early equity.

My Thoughts: This strategy can work well, but with Oahu’s strict short-term rental (STR) rules, you need to be very mindful and thoroughly check the numbers. Most people on the island who "house hack" use the additional units as long-term rentals due to these strict regulations. It's also important to be aware of the permitting process, as fines from the state can be substantial. Ultimately, this is an excellent way for a homeowner to offset their mortgage and living expenses while residing on the island, and it's a goal I'm personally working towards in the next few years.

Short-term Rentals & Value-Add Strategies

In tourist-heavy or high-demand areas, short-term rentals can boost cash flow. Or, look for “value add” opportunities—improve properties (e.g., adding ADUs, renovations) to increase rents and property value.

My Thoughts: As I mentioned earlier, STRs on Oahu are heavily regulated. You need to be located in a resort zone or have a non-conforming use certificate to operate one. In my experience working with buyers, the profit margin on STRs, even with high nightly rates, is often small. I've found that most people who purchase an STR do so not for the cash flow, but for a part-time vacation home and the tax depreciation benefits. That said, I have seen a few savvy investors make it work with a great deal of effort.

Tax Advantages

Leverage real estate’s tax benefits: deduct mortgage interest, depreciation, business expenses, and use 1031 exchanges to defer capital gains taxes when upgrading your portfolio.

My Thoughts: I am a huge believer in finding ways to offset taxes! I've implemented this myself by purchasing an investment property, doing a cost segregation study, and using that to reduce my tax burden. One key thing to remember with depreciation is that land value is not included. Since land is highly valuable in Oahu, to maximize this tax method, it's best to purchase real estate where the land value is less than 30% of the total assessed value. For example, if the land is worth $100K and the building is worth $400K, you can only depreciate the $400K.

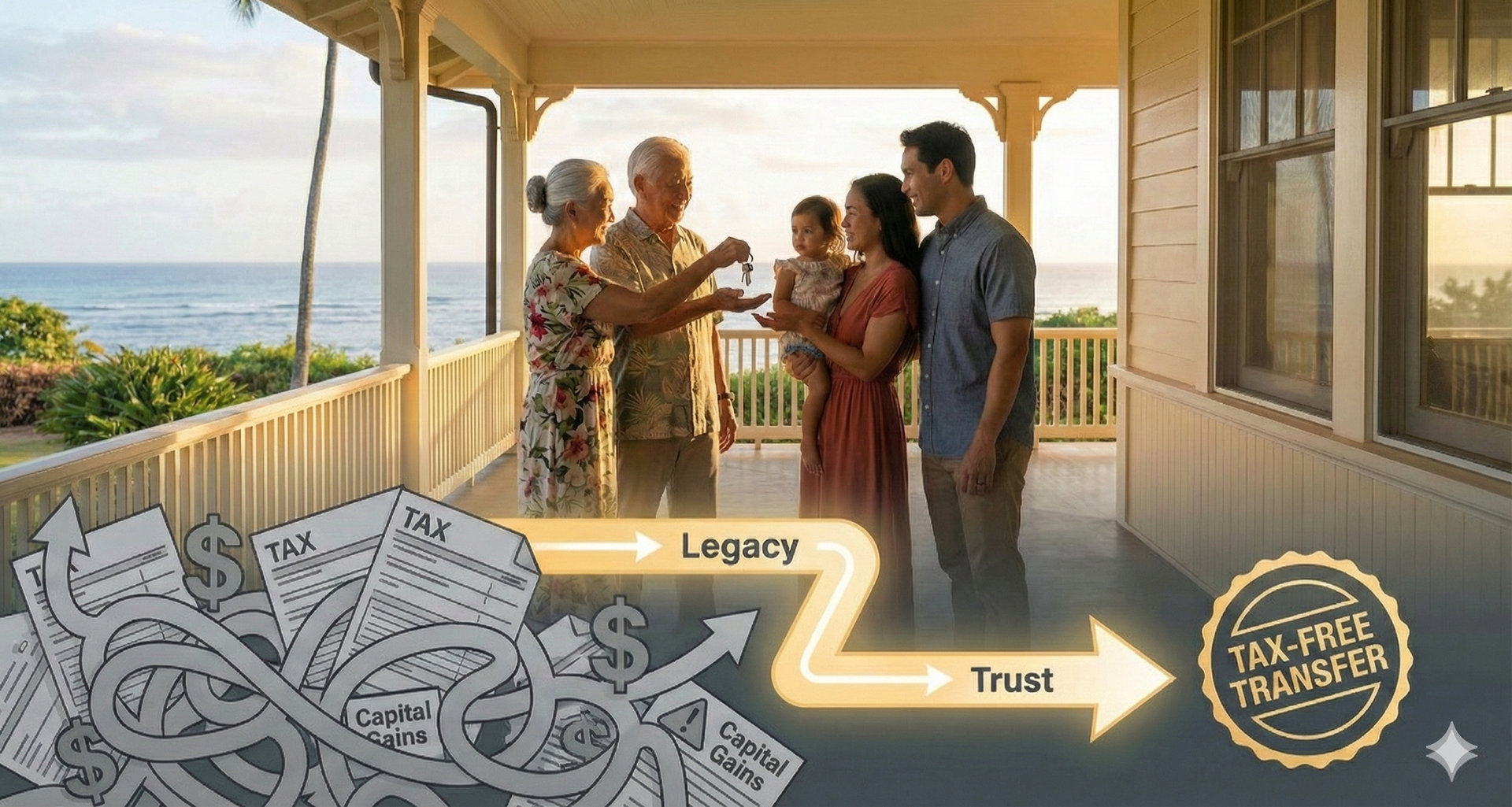

Generational Wealth/Legacy Planning

Plan for the transfer of real estate through trusts, gifting, and estate planning to maximize wealth retention across generations. 2025 is noteworthy due to pending estate tax law changes, giving urgency to strategic inheritance planning for larger portfolios.

My Thoughts: I couldn't agree more. This is a topic I'm personally looking forward to exploring in greater detail.

Passive Investing

Consider REITs, private real estate funds, and syndications if you want cash flow and appreciation without the demands of property management.

My Thoughts: I've found that many of the big investors on Oahu are actively working to provide these types of opportunities to locals. Your best bet is to attend investment networking events to connect with trustworthy people and expand your portfolio.

Ready to make your move in the Oahu market?

Whether you're an experienced investor or just starting out, navigating the unique landscape of Oahu's real estate requires local expertise. I'm here to help you find the right strategy that aligns with your goals. Let's connect!