The 5‑day eviction notice is dead. Hawai‘i landlords need to know this NOW!

Is your rental business ready for 2026? Sticking to the old eviction rules could now cost you months of lost rent.

If you own a rental in Hawaii, you know the drill: laws change, and they usually favor the tenant.

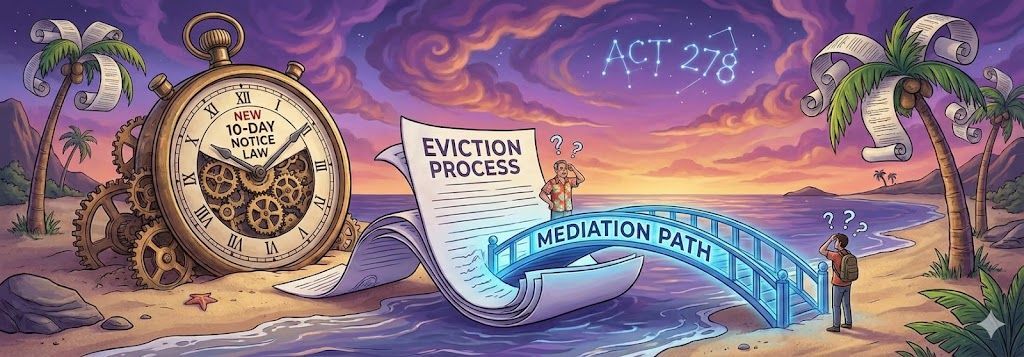

The Hawaii Legislature just passed Act 278, and it’s a big one. The goal? Slow down evictions to encourage mediation.

For you, this means one thing: You need to update your process immediately. The old "5-Day Notice" is gone. If you use it, your case will get thrown out of court.

Here is the plain-English guide to the new 10-Day Notice and what you need to do to protect your property.

The 2 Big Changes You Need to Know

Lawmakers hit the "pause" button on evictions. They want landlords and tenants to talk before going to court.

Here are the two updates that matter most to your bottom line:

1. The 10-Day Rule (Permanent)

The "5-Day Notice" is history. You must now give tenants 10 calendar days to pay rent or move out. This is the new permanent law.

2. Mandatory Mediation (Pilot Program)

From Feb 2026 to Feb 2028, you cannot just file for eviction immediately. You must offer mediation first.

The New Timeline: How to Handle Unpaid Rent

If your tenant misses rent, don't rush to the courthouse. Follow this 3-step flow:

Step 1: Serve the Notice Hand over the new 10-Day Notice to Pay Rent or Vacate.

Step 2: Wait for the Tenant’s Move The tenant has 10 days to do one of three things:

- Pay the rent.

- Move out.

- Schedule mediation.

Step 3: React

- If they schedule mediation: You must wait 20 extra days before you can file for eviction. You also have to show up for the mediation.

- If they do nothing: You can file for eviction on Day 11.

Cheat Sheet: When Can You File for Eviction?

The dates can be confusing. Here are 3 simple scenarios to help you get it right.

Scenario 1: The Tenant Schedules Mediation

Day 0: Tenant gets the notice.

Day 7: Tenant schedules mediation.

Day 10: Notice period ends.

Day 20: The mandatory "pause" ends.

Action: You can file for eviction on Day 21. (Key Takeaway: Even if mediation is set for later—e.g., Day 28—the law allows you to file once the 20-day "pause" is over, provided the tenant scheduled it within the first 10 days.)

Scenario 2: The Tenant Does Nothing

Day 0: Tenant gets the notice.

Day 10: Time is up. No payment, no mediation scheduled.

Action: You can file for eviction on Day 11.

Scenario 3: The Tenant Acts Too Late

Day 0: Tenant gets the notice.

Day 12: Tenant tries to schedule mediation.

Result: They missed the deadline. Action: You were legally allowed to file on Day 11.

Checklist: Is Your Notice Valid?

This is crucial. Under Act 278, if your notice is missing ANY of these items, it is invalid.

Does your notice have...

- [ ] Tenant name & property address?

- [ ] Total rent owed (minus any credits)?

- [ ] Your name & contact info?

- [ ] A statement giving them 10 days to pay or vacate?

- [ ] A clear offer for mediation?

- [ ] Contact info for the mediation centers?

- [ ] Proof you sent a copy to the mediation center?

- [ ] This exact bold warning: If mediation is not scheduled within ten (10) calendar days after receipt of this notice, the landlord may file for summary possession (eviction) after the ten-day period.

The "Oahu Reality" Check

Let’s be honest: Hawaii is a tough place to be a landlord. These changes mean more paperwork, longer waits, and more stress.

For some of you, it’s just a paperwork update. For others, it raises a bigger question: Is the stress of self-managing worth it?

If you're tired of chasing new laws, you have two good options:

- Hire a Pro: Let a property manager handle the compliance headaches. *HINT HINT* ->>> Royal Realty

- Sell: Cashing out might be smarter than risking legal trouble. Let’s chat. I can review your situation and help you build a plan that protects your investment.

Free Resource: Get Your Drafted 10-Day Notice

I don't want you to get stuck with an invalid notice. I’ve put together a template that includes all the new required language.

[Link: Download the Free 10-Day Notice Template Here]

> Disclaimer: I am a real estate pro, not a lawyer. This template is for reference only. Please have a qualified Hawaii attorney review your specific notice before you use it.