The Power of the Pivot: How a 1031 Exchange Shaped This Sale

When a seller first reaches out with a complex goal, it's a chance to execute a high-level strategy. For this client, the mission was clear: navigate a 1031 Exchange. This powerful tax-deferral strategy for real estate investors involved selling two properties—one in California and a condo in Hawaiʻi—and reinvesting both proceeds into a single, larger investment without triggering immediate capital gains taxes. The ultimate goal? To consolidate two separate doors into a single multi-unit property.

What Is a 1031 Exchange?

A 1031 Exchange, named after Section 1031 of the IRS Code, allows investors to defer capital gains taxes when they reinvest the sale proceeds of an investment property into a "like-kind" property. It's a game-changer for building long-term wealth.

Key Benefits of a 1031 Exchange

- Tax Deferral: The most significant perk. Capital gains taxes are deferred, freeing up more capital for your next investment.

- Portfolio Growth: Investors can strategically trade up to larger or more profitable properties, accelerating wealth creation without losing equity to taxes.

- Diversification: You can shift your portfolio from one asset class to another—like trading a residential rental for a commercial building—while staying within IRS guidelines.

- Consolidation or Expansion: Whether you want to combine multiple properties into one or split one property into several, the exchange provides the flexibility to meet your investment goals.

The Rules of the Exchange: Time is Money

The 1031 Exchange is a powerful tool, but it comes with strict, non-negotiable rules. For our client's exchange to succeed, these deadlines and requirements had to be honored:

- Like-Kind Property: All properties must be held for business or investment use. Residential rentals, duplexes, and apartment buildings generally qualify.

- Timing is Critical: You have 45 days from the sale of the first property (the "relinquished" property) to formally identify the replacement property. The closing on the replacement property must occur within 180 days of that first sale.

- Qualified Intermediary (QI): You can never touch the sale proceeds. A Qualified Intermediary must hold the funds and facilitate the entire exchange process.

- Same Taxpayer: The entity or name on the title of the relinquished properties must match the entity or name on the title of the replacement property.

Market Shifts & Strategic Pivots

In our client’s case, the California property sold first, immediately starting the 180-day clock. This put immense pressure on the sale of the Hawaiʻi condo—it needed to close quickly for the funds to be included in the exchange.

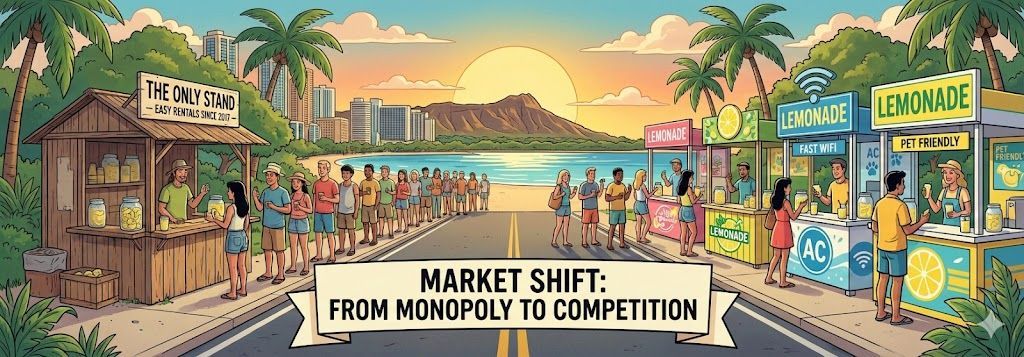

We listed the Hawaiʻi unit in May 2025, but the local market was shifting. Condo prices were dipping, inventory was rising, and buyer interest was cooling. By summer, the unit wasn't moving. The seller was facing a tough reality: either let the 1031 funds lapse and convert the condo back into a long-term rental or pivot the sales strategy.

This is where our collaborative approach came in. We presented two strategic options:

- A simple, cost-effective refresh: A professional re-paint and staging to elevate the unit's appeal, paired with a price reduction to match the new market conditions.

- A quick, value-add renovation: A more significant investment, such as changing the layout to provide the open-kitchen concept that local buyers favored.

The owner opted for the most financially sound, minimal investment: a professional re-paint and staging, followed by a strategic price adjustment. We updated the photos and positioned the unit to compete aggressively in the cooling market.

The Right Buyer at the Right Time

We took a calculated risk to maximize exposure: after a set period, we agreed to list the unit for rent and for sale simultaneously. This strategic move ensured we honored the seller’s financial needs, securing income if a sale didn't materialize immediately.

The strategy worked. Within three weeks of the refresh, we received a compelling offer. The buyers weren’t actively searching; they lived in the building, saw the freshly staged unit listed at the new, market-aligned price, and fell in love. They moved swiftly with their financing with John Keifer, allowing for a seamless close.

This closing wasn't just about selling a condo—it was about timing, trust, and adaptability.

The Victory Lap

The timing aligned perfectly with the seller’s 1031 Exchange timeline. He successfully executed his plan, moving from two separate condos in two different states to one multi-unit property. In an investor’s eyes, this is the ultimate goal: more doors are better!

At Royal Realty, we don't just list a property—we listen, pivot, and maximize every opportunity. Whether your goal is selling, renting, or executing a complex tax strategy like a 1031 Exchange, we're here to help you move forward with confidence.

The 1031 Exchange & Investment Goal Strategy Session: A Free 30-Minute Consultation to Map Out Your Next Move